Who This Is For

Fund Your Snack Truck the Right Way

A professional funding and business credit strategy designed for snack truck and mobile food entrepreneurs who want approvals now — and more funding later.

If you’re planning to start or expand a snack truck or mobile food business, funding the truck is only part of the equation. The way you structure your financing today directly impacts your credit, your business credibility, and your ability to access future funding.

At Four Corner Holdings, we don’t sell “quick approvals.” We align your snack truck funding with real lender underwriting and a long-term business credit strategy — so you don’t get stuck later.

Who This Program Is Designed For

This strategy is built specifically for individuals who are serious about operating a snack truck or mobile food business as a real business — not just buying a vehicle

Entrepreneurs starting a snack truck or food trailer business

You already know what you want to buy, or you’re actively shopping for a snack truck. You want to understand the correct way to get funded without making mistakes that could block future business financing.

Borrowers comparing their financing options

You’re trying to decide between personal financing, equipment financing, or setting up a business first. You want clarity on what lenders actually look for — not sales pitches or internet myths.

Clients who want more than just a truck loan

You don’t just want to fund one truck and stop. You want the ability to expand, add equipment, open additional units, or access future business funding — and you want today’s decision to support that.

Clients with strong credit and clients still building

Some clients qualify today. Others need to build readiness first. This strategy covers both — and shows you the right path based on your profile.

Clear Expectations. Real Underwriting Logic.

List and describe the key features of your solution or service.

What This IS

- An underwriting-based funding strategy

- A clean path to snack truck financing

- A business credit foundation that supports future funding

- A structured process aligned with real lender behavior

What This Is NOT

- No-PG “business credit” hype

- Instant SBA approvals for brand-new businesses

- Credit stacking or risky shortcuts

- Magic approvals for unqualified profiles

The Goal: Fund the Truck and Build the Business Correctly

The objective is not just to get you approved.

The objective is to get you approved without destroying your personal credit — while building a business profile that lenders trust.

That’s how you create long-term funding access, not just a one-time loan.

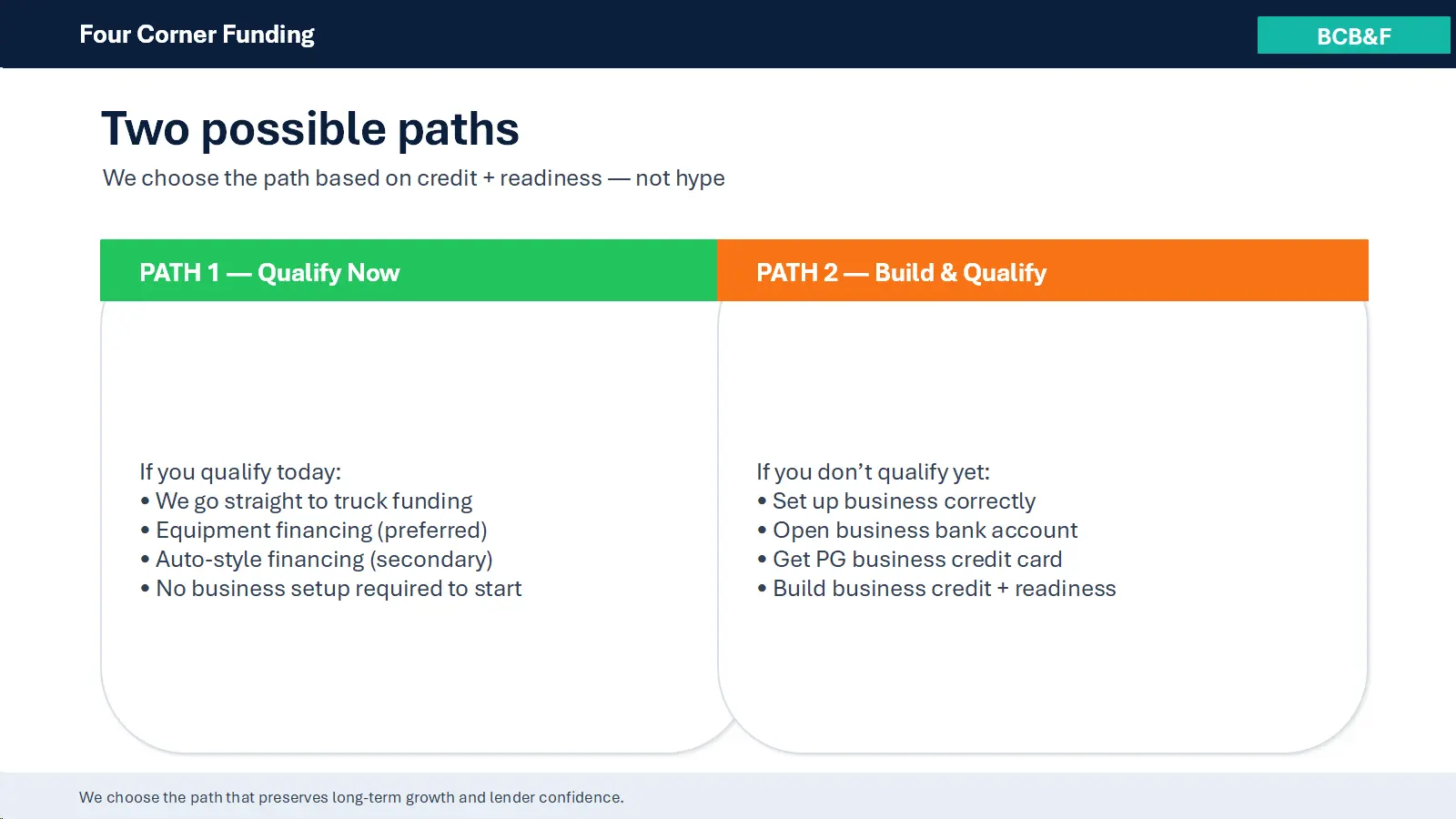

Two Possible Paths — Based on Your Readiness

We don’t force every client into the same process.

We choose the path based on your credit profile, income, and overall readiness.

Path 1 — Qualify Now

If your personal credit and income support it today, we move directly into snack truck funding.

This typically includes:

- Equipment financing (preferred)

- Auto-style financing (secondary option)

- No business setup required to begin the approval process

Even when you qualify now, we still coach you on the best structure for long-term business growth.

Key Point:

“Qualify now” means we skip unnecessary setup steps and focus on funding the truck efficiently.

Path 1 — Qualify Now

If your personal credit and income support it today, we move directly into snack truck funding.

This typically includes:

- Equipment financing (preferred)

- Auto-style financing (secondary option)

- No business setup required to begin the approval process

Even when you qualify now, we still coach you on the best structure for long-term business growth.

Key Point:

“Qualify now” means we skip unnecessary setup steps and focus on funding the truck efficiently.

Path 2 — Build and Qualify

If you don’t qualify yet, we help you build a lender-ready profile the right way.

This includes:

- Setting up the business correctly (LLC + EIN + clean identity alignment)

- Opening a business bank account

- Establishing PG business credit strategically

- Managing utilization and payment history

- Moving into snack truck funding once ready

This is not “delay for delay’s sake.”

This is build to approve.

Why Personal-Only Truck Financing Can Limit You

While personal financing is sometimes possible, it often:

- Limits business scalability

- Blends personal and business risk

- Weakens future business-only funding options

- Signals poorly to future lenders

The smarter approach is building business funding options early — even when a personal guarantee is still required.

Why Business Credit Matters After the Truck

Business credit helps you:

- Build credibility with vendors and lenders

- Increase access to business-only funding

- Separate business risk from personal risk over time

- Support expansion (more trucks, equipment, locations)

We help you build a file that lenders trust.

Let's Connect

- Tell us what snack truck you want (budget, specs, new or used)

- We determine your path (Qualify Now or Build & Qualify)

- We execute funding and position you for future growth

Four Corner Holdings, LLC

Funding approvals, rates, and terms depend on individual credit profile, income, asset details, and lender underwriting criteria. Results are not guaranteed.